Go With the Flowchart

Has the Gift or Trust Been Transferred Correctly?

Has the Gift or Trust Been Transferred Correctly?

Couldn't load pickup availability

Has the Gift or Trust Been Transferred Correctly? – Equity & Trusts Law Flowchart

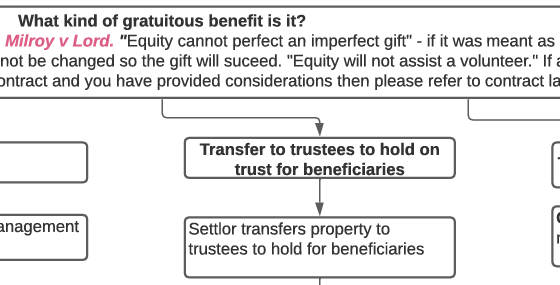

Master the rules on transferring gifts and constituting trusts under English & Welsh law.

This Gift/Trust Transfer Flowchart explains the formalities and exceptions for validly transferring property, whether as an outright gift or into trust. It covers requirements for different types of property, exceptions like Re Rose and Pennington v Waine, and rules that allow equity to perfect imperfect gifts. Perfect for law students, tutors, and legal professionals, this chart turns technical equity & trust principles into an easy-to-follow, exam-ready guide.

📥 Instant Download – Delivered as a high-quality PDF for use on any device or for printing.

📘 Key Topics Covered:

-

Three Modes of Gratuitous Benefit – Milroy v Lord rule, “equity will not assist a volunteer.”

-

Requirements for a Valid Gift – Mental capacity (Re Beaney), intention, certainty of subject matter, and correct transfer formalities.

-

Types of Property & Formalities

-

Land transfers (s52(1) LPA 1925, LP(MP)A 1989)

-

Leasehold land, choses in action, chattels (Jaffa v Taylor Gallery Ltd)

-

Money, shares (Companies Act 2006, Stock Transfer Act 1963)

-

Digital assets (cryptocurrency in B2C2 v Quoine)

-

-

Exceptions to Incomplete Transfers – Re Rose, Mascall v Mascall, Pennington v Waine, detrimental reliance (Curtis v Pulbrook).

-

Strong v Bird Rule – Perfecting imperfect gifts on the donor’s death, requirements for immediate intention and executor appointment.

-

Wills & Automatic Transfers – Role of the three certainties in testamentary dispositions.

✅ Perfect For:

-

Law students (LLB, GDL, SQE, A-levels) revising equity & trusts

-

Tutors & lecturers explaining transfer formalities and exceptions

-

Solicitors & paralegals needing a quick reference tool

-

Anyone handling equity & trust law problem questions